UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission

file number

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was

required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The

aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates was $

As of March 28, 2025, there were shares outstanding of the registrant’s common stock, par value $ per share.

DOCUMENTS INCORPORATED BY REFERENCE

| Auditor Firm PCAOB ID: | Auditor Name: |

Auditor Location: |

EXPLANATORY NOTE

Except for the changes to Part III and Item 15 of Part IV, including the filing of related certifications added to the exhibit list in Part IV, this Amendment makes no changes to the Original 10-K. This Amendment does not reflect events occurring after the filing of the Original 10-K or modify disclosures affected by subsequent events. Terms used but not otherwise defined in this Amendment have such meaning as ascribed to them in the Original 10-K.

TABLE OF CONTENTS

| 2 |

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance |

Our Directors

The following table and the paragraphs following the table set forth information regarding the current ages, positions, and business experience of our directors as of April 29, 2025.

| Name | Position | Age | Initial Year in Office | |||

| Ted Karkus | Chairman of the Board and Chief Executive Officer | 65 | 2009 | |||

| Louis Gleckel, MD | Director | 69 | 2009 | |||

| Warren Hirsch | Director | 67 | 2019 |

TED KARKUS has been the Chairman of the Board and the Chief Executive Officer of the Company since June 2009. Mr. Karkus was instrumental in assisting the turnaround of ID Biomedical, an influenza vaccine manufacturer, which in 2005 was sold to GlaxoSmithKline plc for over $1.4 billion. Mr. Karkus has twenty-five years of experience in securities and capital markets including two years with Fahnestock & Co. Inc., a full-service brokerage firm, where he was Senior Vice President, Director of Institutional Equities, and four years at S.G. Warburg, an investment bank, where he was an institutional equity salesman and developed a large network of institutional investors. Mr. Karkus graduated with an MBA from Columbia University Graduate School of Business in 1984 where he received Beta Gamma Sigma honors. He graduated Magna Cum Laude from Tufts University in 1981.

Mr. Karkus brings extensive financial structuring as well as operational and marketing strategy experience to our Board, including successful restructuring and turn-around scenarios in the pharmaceutical industry. Among his accomplishments, in 2010/2011 he led the restructuring and streamlining of our operations, which resulted in improved sales and margins of our Cold-EEZE brand, and in 2017 succeeded in selling the Cold-EEZE brand for $50 million to Mylan, a multibillion-dollar pharmaceutical company.

| 3 |

LOUIS GLECKEL, MD, has been a member of our Board since June 2009 and currently serves as a member of the Audit Committee and Compensation Committee and as chairman of the Nominating and Corporate Governance Committee. In 1997, Dr. Gleckel co-founded ProHealth Care Associates, a comprehensive state of the art multi-specialty physician group practice with offices in Long Island and Bronx, New York. At ProHealth, he is the Division Chief of Cardiology and Internal Medicine specializing in Preventative Cardiology, Metabolic Syndrome and Internal Medicine with particular emphasis on high-risk patients with complications from diabetes and heart disease. He was named to New York Magazine’s Best Doctors list for three years, New York Metro Area Best Doctors list for 14 years and the 2008 Nassau County Best Doctors list. For over ten years Dr. Gleckel has been a team physician for the New York Jets and New York Islanders as well as for the tennis players at the US Open. Dr. Gleckel also served as Chairman of the Board of Invicta Corporation, a development stage company that designed, manufactured and marketed photochromic eyeglass lenses, for approximately four years until his resignation in February 2005.

Dr. Gleckel brings to the Board extensive knowledge of the medical, pharmaceutical and related industries as a distinguished doctor, as well as experience in successful business development and board service.

WARREN HIRSCH has been a member of our Board since 2019 and currently serves as a member of the Compensation Committee and Nominating and Corporate Governance Committee and as chairman of the Audit Committee. Mr. Hirsch has over 35 years of experience as a Certified Public Accountant. Mr. Hirsch owns and operates Hirsch and Hirsch CPA PLLC, which offers a full range of accounting, tax and small business consulting services. From 2000 to May 2019, Mr. Hirsch served as a registered representative of Royal Alliance, a national financial advisory firm. Mr. Hirsch graduated with a bachelor’s degree in accounting from Hofstra University in 1980.

Mr. Hirsch has extensive knowledge and background related to accounting and financial reporting rules and regulations as well as the evaluation of financial results, internal controls and business processes.

Board of Directors Leadership Structure

Our governance structure combines the roles of principal executive officer and Board Chairman. Mr. Karkus has served as both Chairman and Chief Executive Officer of the Company since June 2009. The Board believes there are important advantages to Mr. Karkus serving in both roles at this time, but may revisit this structure at its discretion in the future. Mr. Karkus is the director most familiar with our Company’s business and industry and is best situated to propose the Board’s agendas and lead Board discussions on important matters. Mr. Karkus provides a strong link between management and the Board, which promotes clear communication and enhances strategic planning and implementation of corporate strategies. Another advantage is the clarity of leadership provided by one person representing the Company to employees, stockholders and other stakeholders. The Board has not named a lead independent director.

Risk Oversight

Our Board is actively involved in oversight of risks that could affect us. This oversight is conducted primarily by our full Board, which has responsibility for general oversight of risks, and through delegation to the Audit Committee. The Board satisfies this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within our Company. The Board believes that full and open communication between management and the Board is essential for effective risk management and oversight.

In addition, our Board monitors our exposure to a variety of risks through our Audit Committee. Our Audit Committee Charter gives the Audit Committee responsibilities and duties that include discussing with management and the independent registered public accounting firm, our major financial risk exposures and the steps management has taken to monitor and control such exposures, including our risk assessment and risk management policies, notably cybersecurity. Pursuant to the Audit Committee Charter, such discussions should also include our exposure to counterparties or other institutions that we believe are at risk of significant financial distress.

| 4 |

Committees of the Board of Directors

The Board has established three committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee (the “Nominating Committee”).

Audit Committee

The current members of the Audit Committee are Ted Karkus, Louis Gleckel and Warren Hirsch. Mr. Hirsch serves as Chairman of the Audit Committee. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has determined that each of Mr. Hirsch and Dr. Gleckel meets the independence requirements of the Nasdaq listing standards for audit committee members. Additionally, our Board has affirmatively determined that each of Mr. Hirsch and Dr. Gleckel is “independent” as defined by the applicable SEC rules regarding audit committee independence. Our Board has determined that Mr. Hirsch qualifies as an “audit committee financial expert” as defined by the rules of the SEC.

The Audit Committee reviews, analyzes and makes recommendations to the Board with respect to the Company’s accounting policies, internal controls and financial statements, consults with the Company’s independent registered public accountants, and reviews filings containing financial information of the Company to be made with the SEC.

The Audit Committee met 6 times during 2024. The Audit Committee operates under a written charter adopted by the Board, which is available on our website at www.ProPhaseLabs.com under “Investor Relations —Governance— Governance Documents.”

Compensation Committee

The current members of the Compensation Committee are Louis Gleckel and Warren Hirsch. Mr. Barr previously served as Chairman of the Compensation Committee during 2024. The Board has determined that each of Mr. Hirsch and Dr. Gleckel meets the independence requirements of the Nasdaq listing standards for compensation committee members.

The Compensation Committee reviews and approves the salary and all other compensation of officers of the Company, including non-cash benefits, incentive-based awards and equity-based awards. The Compensation Committee also administers the Company’s equity incentive plans. The Compensation Committee may form subcommittees and delegate authority to such subcommittees or to one or more of its members when appropriate. The Compensation Committee has the authority to engage consultants.

The Compensation Committee met 3 times during 2024. The Compensation Committee operates under a written charter adopted by the Board, which is available on our website at www.ProPhaseLabs.com under “Investor Relations —Governance— Governance Documents.”

Nominating Committee

The members of the Nominating Committee are Louis Gleckel and Warren Hirsch. Dr. Gleckel serves as Chairman of the Nominating Committee. The Board has determined each of Mr. Hirsch and Dr. Gleckel meets the independence requirements of the Nasdaq listing standards for nominating committee members.

The Nominating Committee is responsible for developing and recommending criteria for selecting new directors and oversees evaluations of the Board and committees of the Board. The Nominating Committee has the responsibility to oversee the Company’s Corporate Governance Guidelines and propose changes to such guidelines from time to time as may be appropriate.

The Nominating Committee met 2 time during 2024. The Nominating Committee operates under a written charter adopted by the Board, which is available on our website at www.ProPhaseLabs.com under “Investor Relations —Governance— Governance Documents.”

| 5 |

Meetings of the Board of Directors in 2024

For the fiscal year ended December 31, 2024, there were 9 meetings of the Board. Each of the directors attended, in person or by telephone, more than 75% of the meetings of the Board and the committees on which he served.

The independent members of the Board met in executive session 5 times during 2024.

Each director is expected to make reasonable efforts to attend Board meetings, meetings of committees of which such director is a member and annual meetings of stockholders. All four of the directors attended the 2024 Annual Meeting of Stockholders either in person or by video conference.

Director Nominations

In selecting candidates for appointment or re-election to the Board, the Nominating Committee considers the following criteria:

| ● | Personal and professional ethics and integrity, including a reputation for integrity and honesty in the business community. | |

| ● | Experience as an executive officer of companies or as a senior leader of complex organizations, including scientific, government, educational, or large not-for-profit organizations. The Nominating Committee may also seek directors who are widely recognized as leaders in the fields of medicine or the biological sciences and manufacturing or business generally, including those who have received awards and honors in their field. | |

| ● | Financial knowledge, including an understanding of finance, accounting, the financial reporting process, and company measures for operating and strategic performance. | |

| ● | Possess the fundamental qualities of intelligence, perceptiveness, fairness, and responsibility. | |

| ● | Ability to critically and independently evaluate business issues, contributing a diverse perspectives or viewpoints, and making practical and mature judgments. | |

| ● | A genuine interest in the Company, and the ability to spend the time required to make substantial contributions as a director. | |

| ● | No conflict of interest or legal impediment that would interfere with the duty of loyalty to the Company and its stockholders. | |

| ● | Current ownership of common stock of the Company, or a willingness to acquire shares of common stock, to further align the interests of non-employee directors with the interests of the Company’s stockholders. |

Directors should have varied educational and professional experiences and backgrounds that, collectively, provide meaningful guidance and counsel to management. Diversity of background, including gender, race, ethnic or national origin, age, and experience in business, government, education, international experience and other areas relevant to the Company’s business are factors considered in the selection process. As a company, we are committed to creating and sustaining a culture of inclusion and fairness. In addition, the Nominating Committee reviews the qualifications of the directors to be appointed to serve as members of the Audit Committee to ensure that they meet the financial literacy and sophistication requirements under applicable Nasdaq rules and that at least one of them qualifies as an “audit committee financial expert” under the applicable SEC rules.

| 6 |

Director Nominations from Stockholders

The Nominating Committee will consider written proposals from stockholders for nominees for director. Any such nominations must be submitted to the Nominating Committee in accordance with Article 2.15 of the Company’s Bylaws to the Secretary at the Company’s principal executive office. For a stockholder to make any nomination of a person or persons for election to the Board at an annual meeting, the stockholder must provide timely notice and certain information about the stockholder and the nominee. to be timely, a stockholder’s notice must be delivered to, or mailed and received at, the principal executive office of the company not less than 90 days nor more than 120 days prior to the one-year anniversary of the preceding year’s annual meeting; provided, however, that if the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the stockholder to be timely must be so delivered, or mailed and received, not later than the 90th day prior to such annual meeting, or, if such meeting is announced later than the 90th day prior to the date of such meeting, not later than the 10th day following the day on which public disclosure (as defined in article 2.15 of the bylaws) of the date of such annual meeting was first made.

Information must be provided for (i) the stockholder providing the notice of the nomination proposed to be made at the meeting, (ii) the beneficial owner or beneficial owners, if different, on whose behalf the notice of the nomination proposed to be made at the meeting is made, (iii) any affiliate or associate of such stockholder or beneficial owner, and (iv) any other person with whom such stockholder or such beneficial owner (or any of their respective affiliates or associates) is acting in concert. Each such person must provide (A) the name and address of such person (including, if applicable, the name and address that appear on the Company’s books and records); and (B) the class or series and number of shares of the Company that are, directly or indirectly, owned of record or beneficially owned (within the meaning of Rule 13d-3 under the Exchange Act), by such person, except that such person will in all events be deemed to beneficially own any shares of any class or series of the Company as to which such person has a right to acquire beneficial ownership at any time in the future. In addition, each person must provide information relating to their derivative and short positions in the Company’s securities, as set out in the Company’s Bylaws.

In addition, each director nominee must provide the same information, as well as all information relating to such proposed nominee that is required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors in a contested election pursuant to Section 14(a) under the Exchange Act (including such proposed nominee’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected), a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships, between or among any nominating stockholder, on the one hand, and each proposed nominee, his or her respective affiliates and associates and any other persons with whom such proposed nominee (or any of his or her respective affiliates and associates) is acting in concert, on the other hand, including, without limitation, all information that would be required to be disclosed pursuant to Item 404 under Regulation S-K if such nominating stockholder were the “registrant” for purposes of such rule and the proposed nominee were a director or executive officer of such registrant, and a completed and signed questionnaire, provided by the Company’s Secretary relating to any voting commitments. The Company may require any proposed nominee to furnish such other information (A) as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as an independent director of the Company or (B) that could be material to a reasonable stockholder’s understanding of the independence or lack of independence of such proposed nominee.

| 7 |

Governance Policies and Procedures

Code of Conduct

We have adopted a code of conduct that applies to all members of our Board and all employees of the Company, including our principal executive officer, principal financial officer and other senior financial officers. The Code of Conduct is available on our website at www.ProPhaseLabs.com under “Investor Relations —Governance— Governance Documents.” We have not granted any waivers under this policy to any of our directors or executive officers. In the event that we amend or waive certain provisions of our code of ethics applicable to our principal executive officer, principal financial officer or principal accounting officer that requires disclosure under applicable SEC rules, we intend to disclose the same on our website.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to promote effective governance of the Company. The Corporate Governance Guidelines are available on our website at www.ProPhaseLabs.com under “Investor Relations —Governance— Governance Documents.”

Whistleblower Policy

The Company has established a whistleblower policy by which confidential complaints may be raised anonymously within the Company. Employees that wish to submit complaints confidentially should submit an anonymous written complaint directly to the Compliance Officer (as described in the policy). Complaints submitted through this confidential process that involve the Company’s accounting, auditing, and internal auditing controls and disclosure practices will be presented to the Audit Committee. The policy is available on our website at www.ProPhaseLabs.com under “Investor Relations —Governance— Governance Documents.”

Insider Trading Policy

The

Company maintains an

The Company’s Insider Trading Policy also provides that directors, officers and employees should not engage in any of the following activities with respect to the securities of the Company: (i) trading in securities on a short-term basis by directors and officers (any security of the Company purchased by an officer or director must be held for a minimum of six months prior to sale, unless the security is subject to forced sale, including as a result of a merger or acquisition involving the Company; (ii) purchase on margin; (iii) short sales; or (iv) buying or selling puts, calls or options to purchase or sell any of the Company’s securities, other than options granted by the Company or bona fide pledges.

Procedures for Contacting Directors

The Company has adopted a procedure by which stockholders may send communications to one or more members of the Board by writing to such director(s) or to the whole Board, care of the Corporate Secretary, ProPhase Labs, Inc., 711 Stewart Avenue, Suite 200, Garden City, New York 11530. The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Board Communication” or “Director Communication.” All such letters must clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Secretary will make copies of all such letters and circulate them to the appropriate director or directors.

| 8 |

Our Executive Officers

The following table and the paragraphs following the table set forth information regarding the current ages, positions, and business experience of the current executive officers of the Company as of April 29, 2025.

| Name | Position | Age | ||

| Ted Karkus | Chairman of the Board and Chief Executive Officer | 65 | ||

| Stu Hollenshead | Chief Operating Officer | 41 |

See “Our Directors” for Mr. Karkus’s biography.

STU HOLLENSHEAD is a seasoned C-level executive with 15+ years of experience in media, e-commerce, marketing, and technology. He has led growth, monetization, and audience engagement for top digital brands.

At TheStreet, he scaled DTC subscriptions to $30M and pioneered AI-driven content automation. At Business Insider, he drove audience growth, contributing to its $442M acquisition by Axel Springer. At WWE, he helped WWE Network reach nearly 2M subscribers.

As COO & CBO of Barstool Sports, he led record-breaking expansion, culminating in its $551M acquisition by Penn Entertainment. Now simultaneously CEO of 10PM Curfew, a female-centric platform with an audience of 70M+, Stu continues to build and scale high-growth businesses each and every day.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers has been involved in any material legal proceeding during the past ten years.

Family Relationships

There are no family relationships among any of our directors or executive officers.

| Item 11. | Executive Compensation |

Summary Compensation Table (2024 and 2023)

The following summary compensation table sets forth the total compensation paid or accrued for the years ended December 31, 2024 and 2023 to our Chief Executive Officer, our former Chief Accounting Officer and our former Chief Financial Officers. We refer to these officers as our “named executive officers” for 2024 and 2023.

NOTE REGARDING VALUATION OF OPTION AWARDS

The amounts reported in the “Option Awards” column represent the aggregate grant-date fair value of stock option awards calculated in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718, “Compensation—Stock Compensation.” The fair value of each option award is based on the Black-Scholes option pricing model and reflects accounting assumptions required under U.S. generally accepted accounting principles (GAAP), not the actual economic value realized by the executive.

| 9 |

These

accounting-based values are intended to reflect the estimated cost to the Company at the time of grant and are not necessarily indicative

of any value the executive has received or will ultimately receive. Importantly, the stock options granted to our named executive officers,

including our Chief Executive Officer, have consistently had exercise prices equal to or greater than the market price of our common

stock on the date of grant. As of the date of this filing, all such options remain underwater, meaning the current market price of our

stock is below the exercise price of the options. Accordingly, these options have no intrinsic value and provide no economic benefit

to the executives unless and until the Company’s stock price increases materially above the grant price.

The following

stock option grants were made in 2023 and 2024 and are included in the compensation valuation disclosures:

● Ted Karkus

(CEO): 400,000 options granted on March 17, 2024, with an exercise price of $6.00 per share.

● Ted Karkus (CEO): 400,000 options

granted on April 4, 2023, with an exercise price of $9.00 per share.

● Robert Morse (CFO): 50,000 options granted on April

4, 2023, with an exercise price of $9.00 per share.

● Stuart Hollenshead (COO): 500,000 options granted on February 17, 2025,

with an exercise price of $6.00 per share (inducement award granted outside a shareholder-approved plan).

Investors should therefore interpret the values disclosed in the compensation tables as accounting estimates—not as current or guaranteed compensation to the executive officers. These options currently have no intrinsic value.

| Name and Principal Position | Year | Salary ($) | Bonus ($)(1) | Option Awards ($) | All Other Compensation ($)(2) | Total ($) | ||||||||||||||||

| Ted Karkus | 2024 | 675,000 | 200,000 | 1,220,000 | 28,200 | 2,123,200 | ||||||||||||||||

| Chief Executive Officer | 2023 | 675,000 | 200,000 | 2,465,000 | 27,200 | 3,367,200 | ||||||||||||||||

| Jed Latkin(3) | 2024 | 350,000 | 80,000 | 1,315,000 | 27,200 | 1,772,200 | ||||||||||||||||

| Chief Operating Officer | 2023 | — | — | — | — | — | ||||||||||||||||

| Robert Morse | 2024 | 126,827 | — | — | — | — | ||||||||||||||||

| Former Chief Financial Officer | 2023 | 275,000 | 19,890 | 246,500 | — | 541,390 | ||||||||||||||||

| Monica Brady(4) | 2024 | — | — | — | — | — | ||||||||||||||||

| Former Chief Accounting Officer | 2023 | 200,000 | — | — | 10,680 | 210,680 | ||||||||||||||||

| (1) | For Mr. Karkus, the amount reported for 2024 consists of a $200,000 discretionary bonus awarded to Mr. Karkus in April 2024 for his 2023 contributions to the Company and for 2023 consists of a $200,000 discretionary bonus awarded to Mr. Karkus in March 2023 for his 2022 contributions to the Company.

For Mr. Latkin, the amount reported for 2024 consists of a $80,000 sign-on bonus awarded to Mr. Latkin in January 2024, which was in conjunction with his employment agreement.

For Mr. Morse, the amount reported for 2023 consists of a $19,890 discretionary bonus awarded to Mr. Morse in March 2023 for his 2022 contributions to the Company. |

| (2) | For Mr. Karkus, the amounts reported for 2024 2023 consists of a $15,000 vehicle allowance and a $13,200 matching contribution to the Company’s 401(k) defined contribution plan and 2023 consists of a $15,000 vehicle allowance and a $12,200 matching contribution to the Company’s 401(k) defined contribution plan.

For Mr. Latkin, the amount reported for 2024 consists of a $10,800 vehicle allowance and a $16,400 matching contribution to the Company’s 401(k) defined contribution plan.

For Ms. Brady, the amounts reported for 2023 consists of a $5,000 vehicle allowance and a $5,680 matching contribution in the Company’s 401(k) defined contribution plan. |

| (3) | Mr. Latkin served as Chief Operating Officer effective January 1, 2024. Mr. Latkin resigned as Chief Operating Officer effective February 14, 2025. |

| (4) | Ms. Brady resigned as Chief Accounting Officer effective January 13, 2023. |

| 10 |

Compensation Philosophy

Our Compensation Committee believes that the most effective compensation program should:

| ● | attract and retain talented executives who will lead us through the challenges that we may face and put us in a position to grow and succeed; | |

| ● | motivate our executives to achieve short-term, medium-term and long-term financial and strategic goals; | |

| ● | reward our executives for the achievement of individual and corporate objectives; and | |

| ● | align the interests of management with those of our stockholders by providing incentives for superior performance that improves stockholder value. |

There is no pre-established policy or target for the allocation between either cash and non-cash or short-term, medium-term and long-term incentive compensation. This approach provides our Compensation Committee the ability to evaluate the compensation package from year to year with the flexibility to configure allocations and amounts in a manner that aligns closely with stockholder interests. The Compensation Committee considers our corporate performance, individual performance, and the economic environment in general and in our industry when it makes compensation decisions. The Compensation Committee uses these factors, in conjunction with its overall compensation philosophy, when it determines compensation to be awarded to our executive officers during a fiscal year.

While we do not have any policy for the proportion of compensation that should be allocated as cash or non-cash, or short or long-term, we have historically paid our executive officers a greater percentage of their total compensation as base salary. This is due to market factors in our industry and the specific situations facing our Company. It is important for us to retain the services of our talented and experienced executive team through market fluctuations. To do so, we believe that it is important to provide a certain amount of fixed compensation that will give our executive officers some assurance as to the level of compensation they will earn.

We have utilized annual bonus awards to reward results or extraordinary efforts, which motivates our executive officers to produce positive short-term results. We grant stock options and other stock-based awards, which align the long-term interests of our executive officers to the interests of our stockholders by making our executive officers stakeholders in the Company and tying their long-term interests to our success.

Our Compensation Committee does not specifically benchmark the compensation of our executives to the pay of other executives in companies of similar size in our industry, given the unique challenges that are faced by other companies of our size in our industry. However, we have historically compared the level of our executives’ compensation against the compensation of other companies in our industry in general, and believe that the level of compensation our executives receive is within the range of compensation paid to other executives in our industry. We use these compensation checks to ensure that our executives are being appropriately rewarded and to discourage their departure to any competitor.

Regarding most compensation matters, the Chief Executive Officer’s responsibility is to provide recommendations to the Compensation Committee based on an analysis of market standards and trends and an evaluation of the contribution of each executive officer to the Company’s performance. Our Compensation Committee considers, but retains the right to accept, reject or modify such recommendations. Neither the Chief Executive Officer nor any other member of management is present during executive sessions of the Compensation Committee. Moreover, the Chief Executive Officer is not present when decisions with respect to his compensation are made.

2022 Advisory Stockholder Vote on Executive Compensation

On May 19, 2022, at our 2022 Annual Meeting of Stockholders, our stockholders overwhelmingly approved, on a non-binding advisory basis, the compensation of the Company’s named executive officers, including the Company’s compensation practices and principles and their implementation, as discussed and disclosed in the compensation tables and related narrative disclosure (the “Say on Pay Vote”) contained in our 2022 Proxy Statement. The Compensation Committee appreciates and values the views of our stockholders. In light of the strong level of support of the overall pay practices, and of the general effectiveness of our long-standing compensation policies, the Board and the Compensation Committee have not made any specific changes to our executive compensation program.

At the 2019 Annual Meeting of Stockholders on May 22, 2019, our stockholders expressed a preference that our Say on Pay Vote occur every three years. In accordance with the results of this vote, the Board determined to implement a Say on Pay Vote every three years. As such, our Board will provide a Say on Pay Vote among the matters to be considered at the Company’s 2025 Annual Meeting of stockholders. The next required vote on the frequency of Say on Pay Votes, which is required to be held at least every six years, will be held at our 2025 Annual Meeting of stockholders.

| 11 |

Elements of Compensation

Subject to variation where appropriate, the elements of compensation to our named executive officers include:

| ● | base salary, which is determined on an annual basis and is generally set forth in employment agreements with our executives; | |

| ● | annual cash incentive compensation, which is awarded by our Compensation Committee on a discretionary basis, determined based on the Company and individual performance in the applicable fiscal year; and | |

| ● | long-term incentive compensation in the form of options and other stock-based awards. |

Base Salary and Annual Bonus

Base salaries are an integral component of our total compensation program, and setting base salaries at competitive levels helps us to attract and retain senior executives. Base salary is the only fixed component of compensation for our executives. The base salaries for our named executive officers were determined based on the Compensation Committee’s evaluation of the competitive marketplace, the salaries of our other executives, and the scope of each named executive officer’s responsibilities. The base salaries of our named executive officers were set at the level deemed necessary to secure their employment for an extended period and to appropriately reward them for the multiple roles they played for our Company.

Our annual bonus opportunity is intended to incentivize the achievement of our short-term goals. On an annual basis, generally in mid-December, our Compensation Committee assesses the individual performance of each of our executive officers and the performance of the Company and determines the appropriate annual bonus award, if any, for our executive officers. We do not use pre-established targets for the annual bonus award because market factors that affect our Company’s performance are unpredictable, and thus it would be difficult to set goals at the beginning of the fiscal year that would appropriately motivate our executive officers throughout the year. By basing the annual incentive on assessments made at the end of the year of the performance of the individual executives and the Company, and occasionally making mid-year determinations where the circumstances warrant an immediate reward, we can take all market factors into account and reward our executive officers appropriately for their performance.

Equity Compensation Plans

Our Compensation Committee believes that equity-based participation provides our executive officers a strong economic interest in maximizing stock price appreciation over the long term and aligns their interests with those of our stockholders. Equity-based awards are made pursuant to the Company’s equity incentive plans, including the Amended and Restated 2022 Equity Compensation Plan and the Amended 2021 Omnibus Equity Incentive Plan.

On June 16, 2023, at our 2023 Annual Meeting of Stockholders, our stockholders overwhelmingly approved the Amended and Restated 2022 Equity Compensation Plan, which had been previously approved by the Board of Directors on April 23, 2023. The Amended and Restated 2022 Equity Compensation Plan provides for the grant of stock options, stock appreciation rights, restricted stock awards, restricted stock units, and other stock-based awards to our employees, directors, and consultants. The material terms of this plan, including the number of shares authorized for issuance, are described in Proposal 3 of our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 27, 2023, which description is incorporated herein by reference.

On June 20, 2024, our stockholders approved an amendment to the 2021 Omnibus Equity Incentive Plan (the “Amended 2021 Plan”) to increase the number of shares authorized for issuance thereunder. The Amended 2021 Plan, like the Amended and Restated 2022 Equity Compensation Plan, allows for the grant of stock options, stock appreciation rights, and other stock-based awards. The material terms of the Amended 2021 Plan are described in Proposal 2 of our Definitive Proxy Statement on Schedule 14A, filed with the SEC on May 15, 2024, which description is incorporated herein by reference.

The Amended and Restated 2022 Equity Compensation Plan has served as a key retention tool. Retention is a significant factor in determining both the type of award granted and the number of shares underlying each award. Our Compensation Committee also considers cost to the Company and our goal of using equity awards to drive and reward performance over time. Stock options, restricted shares, and other stock-based grants are used to promote long-term value creation, reward continued service, and align the interests of key employees and executives with those of stockholders.

In determining the size of an option, restricted stock, or other stock grant to a named executive officer, both upon initial hire and on an ongoing basis, our Compensation Committee considers competitive market factors, the size of the available equity incentive pool, cost to the Company, the executive’s current equity holdings, and individual contributions to corporate performance.

Although we do not maintain a specific target for equity ownership, our Compensation Committee recognizes that equity participation encourages executive focus on stock price performance, enhances retention, and supports alignment with stockholder interests. Accordingly, the exercise price of stock options is tied to the fair market value of our common stock on the date of grant. Option grants typically vest over two to three years, although longer vesting periods or immediate vesting may be approved depending on circumstances. The Committee does not use a fixed formula to determine the size of awards, which may vary from year to year based on the factors described above.

Consistent with our executive compensation philosophy, our Compensation Committee continues to utilize equity awards such as restricted stock to align executive and stockholder interests. The value of such awards is linked directly to our stock price, which in turn reflects overall Company and individual executive performance.

In 2024, the Compensation Committee adopted an annual equity grant cadence for key employees, including executive officers, to align with market practice, smooth the impact of stock price volatility, and enhance retention through long-term vesting. These annual grants are distinct from any performance or bonus-based equity awards, which are evaluated separately. As part of this cadence, in March 2024, the Compensation Committee approved stock option grants to Mr. Ted Karkus and other key employees under the Amended and Restated 2022 Equity Compensation Plan.

| 12 |

Defined Contribution Plan

In 1999, we implemented a 401(k) defined contribution plan for our employees. The 401(k) plan is the Company’s primary retirement benefit for its employees, including its executives. For executive officers, as well as all other employees, the Company makes a contribution to the plan annually based on the amount of the employee’s 401(k) plan contributions and compensation. The contribution to the plan by the Company consists of a 100% match of the employee’s contribution, up to 4% per person, per annum. The Company’s total contribution to the 401(k) plan in 2024 for its named executive officers, in the aggregate, was approximately $25,400. Company contributions to the Company’s 401(k) plan are included in the Summary Compensation Table as “Other Compensation.”

The Company does not provide its executive officers with any type of defined benefit retirement benefit or the opportunity to defer compensation pursuant to a non-qualified deferred compensation plan.

Perquisites and Other Personal Benefits

The Company provides executives with limited personal benefits. The Compensation Committee reviews annually the levels of personal benefits provided to the executives. Medical and dental insurance is provided to each executive, along with all other eligible employees, subject to the same terms and conditions, including premium payments that apply to all other eligible employees. Life and disability insurance is provided to each executive at no cost to the executive. All such welfare benefits terminate at the time each executive is no longer employed with the Company or as otherwise provided in the applicable employment agreement (except as otherwise required by continuation coverage laws).

Employment Agreements

Amended and Restated CEO Employment Agreement

On February 16, 2018, the Board approved the Amended and Restated 2015 Executive Employment Agreement with Mr. Karkus (the “CEO Employment Agreement”), which became effective February 23, 2018 (the “Effective Date”), subject to stockholder approval, which was subsequently attained at the Company’s 2018 Annual Meeting of Stockholders held on April 12, 2018.

Under the CEO Employment Agreement, Mr. Karkus’ current base salary is $675,000 per annum. Mr. Karkus is eligible to receive a bonus in the sole discretion of the Compensation Committee, and is also eligible to receive regular benefits routinely provided to senior executives of the Company.

Under the terms of the CEO Employment Agreement, in the event of a termination of Mr. Karkus’ employment by the Company for “Cause” or due to his voluntary resignation without a “Good Reason” (as such terms are defined in the CEO Employment Agreement) (each an “Ineligible Termination”), no severance benefits will become payable to Mr. Karkus. If, however, Mr. Karkus’ employment is terminated by the Company for any reason other than termination for Cause or due to his voluntary resignation without Good Reason, then Mr. Karkus will be entitled to receive the benefits and payments set forth below.

| 13 |

Under the terms of the CEO Employment Agreement, Mr. Karkus is eligible to receive the following benefits and cash payments in the event of a termination of employment other than an Ineligible Termination:

| ● | A cash severance payment equal to 2.5 times his then current base salary (i.e., 250% of his then current base salary). Such cash severance payment will be paid as follows: (x) one-half of the cash severance payment will be paid in a lump sum within five business days following the effective date of the termination; and (y) the remaining one-half of the cash severance payment will be paid in 12 equal, consecutive, monthly installments commencing on the first business day of the month following the effective date of the termination; and | |

| ● | All of his outstanding and unvested stock options and/or restricted stock will automatically vest concurrently upon such termination of employment, regardless of any prior existing vesting schedules. |

If Mr. Karkus’s employment terminates by reason of his death or disability, then the cash payments described above under will be paid only to the extent of the proceeds payable to the Company through a “key man” life, disability or similar insurance relating to the death or disability of Mr. Karkus.

In the event that Mr. Karkus has received a cash payment described above in connection with his termination of employment and it is determined that his employment termination was in connection with a Change in Control (as defined in the CEO Employment Agreement), then Mr. Karkus will be entitled to receive an additional payment as described below, less the amount of payments previously received in connection with the termination of employment.

In the event Mr. Karkus’ employment terminates due to a reason other than an Ineligible Termination, death or disability, and if such termination occurs within (i) 18 months following a Change in Control, or (ii) prior to a Change in Control but in contemplation of a Change in Control and the Change in Control actually occurs, then, in lieu of the cash payments described above, he will instead receive a one-time payment in cash equal to $2,500,000. In addition, in such event, all of Mr. Karkus’ stock options and/or restricted stock will automatically vest concurrently upon such termination of employment, regardless of any prior existing vesting schedule.

The involuntary termination of Mr. Karkus’ employment due to a reason other than an Ineligible Termination, death or disability within 180 days preceding a Change in Control will be deemed to have been a termination of employment in contemplation of a Change in Control. In determining whether a termination of Mr. Karkus’ employment occurring more than 180 days preceding a Change in Control (due to a reason other than an Ineligible Termination, death or disability) constitutes a termination of employment in contemplation of a Change in Control, the court or other tribunal making such determination will consider the totality of facts and circumstances surrounding such termination of employment.

In addition, Mr. Karkus, and his eligible dependents, will be entitled to Company-paid COBRA continuation coverage premiums under the Company’s welfare plans, for a period of up to 18 months. Notwithstanding the above, if a termination of employment occurs as a result of death or disability, then any cash severance payment will only be made to the extent that the proceeds are payable to the Company through a “key man” life, disability or similar insurance policy.

No Excise Tax Gross-Up

The CEO Employment Agreement does not provide for tax reimbursement payments or gross-ups related to any change in control. Under the terms of his CEO Employment Agreement, if any payments payable or benefits provided to Mr. Karkus become subject to the excise tax imposed by Section 4999 of the Internal Revenue Code or to any similar tax imposed by state or local law, then the aggregate amount of payments payable to Mr. Karkus will be reduced to the aggregate amount of payments that could be made without incurring such excise tax, provided that such reduction will only be imposed if the aggregate after-tax value of the payments retained by Mr. Karkus (after giving effect to such reduction) is equal to or greater than the aggregate after-tax value (after giving effect to the excise tax) of the payments without any such reduction.

| 14 |

Clawback Provision

The CEO Employment Agreement includes a clawback provision. In the event the following events occur:

| ● | a mandatory restatement of the Company’s financial results occurs while the Company remains publicly traded and is attributable to misconduct or wrongdoing by Mr. Karkus; | |

| ● | Mr. Karkus received a payment of a cash bonus or was issued any Company shares as a bonus within three years preceding the mandatory restatement; and | |

| ● | the amount of such cash bonus or share grant was calculated and awarded pursuant to a specific financial formula, and the cash bonus or share grant would have been diminished based on the restated financial results had the financial formula been applied using the restated financial results; |

then Mr. Karkus will be required to remit to the Company the amount by which the original cash bonus or share grant would have been diminished, net of taxes originally paid. However, if the net effect of the restatement is effectively neutral to the Company over the applicable time periods, then no clawback amount will be due from Mr. Karkus.

Subsequent Event – Executive Compensation Deferral

In February 2025, Mr. Karkus voluntarily agreed to defer all of his salary compensation in excess of $200,000 per annum until the earlier of (i) the sale of the Company’s wholly owned subsidiary, Nebula Genomics, Inc., or (ii) the successful collection of certain accounts receivable related to laboratory testing services performed during the COVID-19 pandemic; or (iii) another significant liquidity event. These deferred compensation arrangements are designed to support the Company’s short-term liquidity objectives and strategic initiatives.

In addition, other members of senior management have also voluntarily agreed to defer a portion of their salary compensation under similar terms. These deferrals reflect the leadership team’s commitment to the long-term success of the Company and alignment with stockholder interests.

Compensation Arrangement with Robert A. Morse

On April 4, 2023, the Company promoted Robert A. Morse, Jr. from Controller to Chief Financial Officer. In connection with his promotion, the Compensation Committee approved a new compensation package consisting of an annual base salary of $275,000 and a grant of stock options to purchase 50,000 shares of the Company's common stock under the Amended and Restated 2022 Equity Compensation Plan. The options have an exercise price of $9.00 per share, a term of seven years, and vest in equal annual installments over a three-year period commencing on the first anniversary of the grant date, subject to Mr. Morse’s continued employment with the Company.

Mr. Morse received an annual base salary of $275,000 from April 2023 through December 2023 for his service as Chief Financial Officer. Mr. Morse resigned on May 31, 2024.

Compensation Arrangement with Monica Brady

Ms. Brady received an annual base salary of $200,000 for 2023. She was also eligible to receive a bonus and equity awards in the sole discretion of the Compensation Committee, as well as regular benefits routinely provided to other senior executives of the Company.

| 15 |

Outstanding Equity Awards at 2024 Fiscal Year End

The following table sets forth information concerning outstanding equity awards held by each of our named executive officers for the last completed fiscal year of December 31, 2024, as of December 31, 2024.

| Option Awards | ||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | ||||||||||||

| Ted Karkus | 100,000 | (1) | 400,000 | (1) | 9.00 | 4/4/2030 | ||||||||||

| 100,000 | (2) | 300,000 | (2) | 6.00 | 3/16/2031 | |||||||||||

| Jed Latkin | 17,500 | (3) | 17,500 | (3) | 6.84 | 3/12/2030 | ||||||||||

| 125,000 | (4) | 375,000 | (4) | 6.00 | 12/31/2030 | |||||||||||

| Robert Morse | - | (5) | - | (5) | - | - | ||||||||||

| (1) | Award of 500,000 options was granted on April 4, 2024 was scheduled to vest in 5 equal annual installments beginning on April 4, 2024, subject to Mr. Karkus continued service through each vesting date. | |

| (2) |

Award of 400,000 options was granted on March 17, 2024 was scheduled to vest in 4 equal annual installments beginning on March 17, 2024, subject to Mr. Karkus continued service through each vesting date. | |

| (3) |

Award of 35,000 options was granted on March 13, 2023 was scheduled to vest in 4 equal annual installments beginning on March 13, 2023, subject to Mr. Latkin continued service through each vesting date. | |

| (4) | Award of 125,000 options was granted on January 1, 2024 was scheduled to vest in 4 equal annual installments beginning on January 1, 2024, subject to Mr. Latkin continued service through each vesting date. | |

| (5) | As of December 31, 2024, Mr. Morse had no outstanding or exercisable options. |

Pay Versus Performance

The following table reports the compensation of our Principal Executive Officer (the “PEO”) and the average compensation of the other named executive officers for the respective fiscal year (“Other NEOs”) as reported in the Summary Compensation Table for the past two fiscal years as provided in this Amendment and the Company’s proxy statement as filed with the SEC on April 27, 2023, as well as their “compensation actually paid” as calculated pursuant to recently adopted SEC rules and certain performance measures required by the rules.

The table below presents the relationship between executive compensation actually paid and the Company’s financial performance, as required by Item 402(v) of Regulation S-K. The “compensation actually paid” to our PEO and our non-PEO NEOs” is determined in accordance with SEC rules and differs meaningfully from the total compensation reported in the Summary Compensation Table (“SCT”).

To calculate “compensation actually paid,” we begin with the SCT total and then apply adjustments as prescribed by SEC guidance, including:

● Subtracting the grant date fair value of equity awards included in the SCT;

● Adding or subtracting the change in fair value of equity awards granted in current and prior years that remained outstanding at year-end;

● Adding the fair value at vesting for awards that vested during the year;

● Subtracting prior-year fair values of awards that were forfeited or expired during the year;

● Including dividends or other earnings on stock or option awards, if not otherwise reflected in fair value.

These adjustments result in a figure that includes the accounting-based fair value of equity awards, which may fluctuate from year to year based on changes in our stock price and other valuation inputs, regardless of whether such awards have been exercised or settled. In certain cases, the compensation actually paid may include the fair value of stock options or other equity awards that are currently unexercised and/or out-of-the-money, meaning their exercise price exceeds the current market price of our common stock. The options do not currently have and have not had any intrinsic value since the grant.

As a result, the values reported under “compensation actually paid” should be understood as reflective of accounting valuations based on prescribed methodologies, and not necessarily as amounts received, earned, or realized by the executive officers during the applicable year.

| Year | Summary Compensation Table Total for PEO(1) ($) | Compensation Actually Paid to CEO(3)(4) ($) | Average Summary Compensation Table Total for Other NEOs(2) ($) | Average Compensation Actually Paid to Other NEOs(3)(4) ($) | Value of Initial Fixed $100 Investment Based on: Total Shareholder Return(5) ($) | Net Income | ||||||||||||||||||

| 2024 | 2,123,200 | 497,200 | 1,772,200 | 823,450 | 7.86 | (53,364 | ) | |||||||||||||||||

| 2023 | 3,367,200 | 1,922,200 | 370,695 | 226,195 | 46.94 | (16,782 | ) | |||||||||||||||||

| (1) | The amounts reflect the Summary Compensation Table total compensation for Ted Karkus, our PEO for each of the years listed. |

| (2) | For 2024, the amount reflects the Summary Compensation Table average compensation total for Jed Latkin, our Chief Operating Officer and Robert Morse, our former Chief Financial Officer. For 2023, the amount reflects the Summary Compensation Table average compensation total for Robert Morse, our former Chief Financial Officer and for Monica Brady, our former Chief Accounting Officer. |

| 16 |

| (3) | The amounts shown for Compensation Actually Paid to our PEO and Average Compensation Actually Paid to the Other NEOs have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually realized or received by such persons. These amounts reflect total compensation as set forth in the Summary Compensation Table above for each year, adjusted as described in footnote 4 below. |

| (4) | The dollar amounts reported in these columns represent the amounts of “compensation actually paid.” The amounts are computed in accordance with Item 402(v) of Regulation S-K by deducting and adding the following amounts from the “Total” column of the SCT (pursuant to SEC rules, fair value at each measurement date is computed in a manner consistent with the fair value methodology used to account for share-based payments in our financial statements under GAAP). |

| 2024 | 2023 | |||||||||||||||

| SCT Total to CAP Reconciliation | PEO | Other NEOs | PEO | Other NEOs | ||||||||||||

| SCT Total | $ | 2,123,200 | $ | 1,772,200 | $ | 3,367,200 | $ | 370,695 | ||||||||

| (Deduct): Aggregate value for stock awards and option awards included in SCT Total for the covered fiscal year | (1,220,000 | ) | (1,315,000 | ) | (2,465,000 | ) | (246,500 | ) | ||||||||

| Add: Fair value at year end of awards granted during the covered fiscal year that were outstanding and unvested at the covered fiscal year end | 33,000 | 37,500 | 1,020,000 | 102,000 | ||||||||||||

| Add (Deduct): Year-over-year change in fair value at covered fiscal year end of awards granted in any prior fiscal year that were outstanding and unvested at the covered fiscal year end | (796,000 | ) | - | - | - | |||||||||||

| Add: Vesting date fair value of awards granted and vested during the covered fiscal year | 305,000 | 328,750 | - | - | ||||||||||||

| Add (Deduct): Changes as of the vesting date (from the end of the prior fiscal year) in fair value of awards granted in any prior fiscal year for which vesting conditions were satisfied during the covered fiscal year | 52,000 | - | - | - | ||||||||||||

| CAP Amounts (as calculated) | $ | 497,200 | $ | 823,450 | $ | 1,922,200 | $ | 226,195 | ||||||||

| (5) | This column shows Total Shareholder Return (“TSR”) on a cumulative basis for each year of the two-year period from 2023 through 2024. Dollar values assume $100 was invested for the cumulative period from December 31, 2023 through December 31, 2024 in the Company. Historical performance is not necessarily indicative of future stock performance. |

| 17 |

Pay for Performance Relationship

In accordance with Item 402(v) of Regulation S-K, we are providing the following descriptions of the relationships between information presented in the Pay Versus Performance table above.

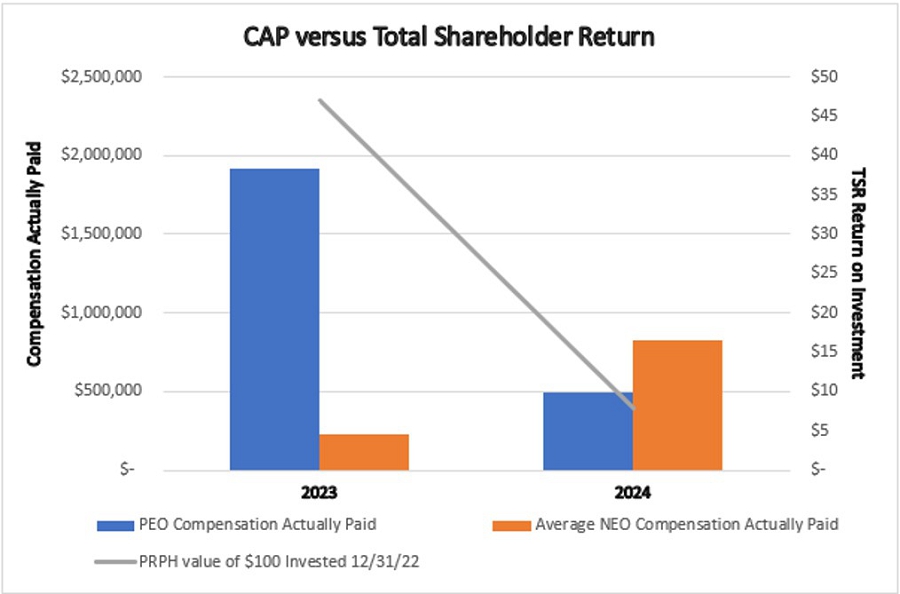

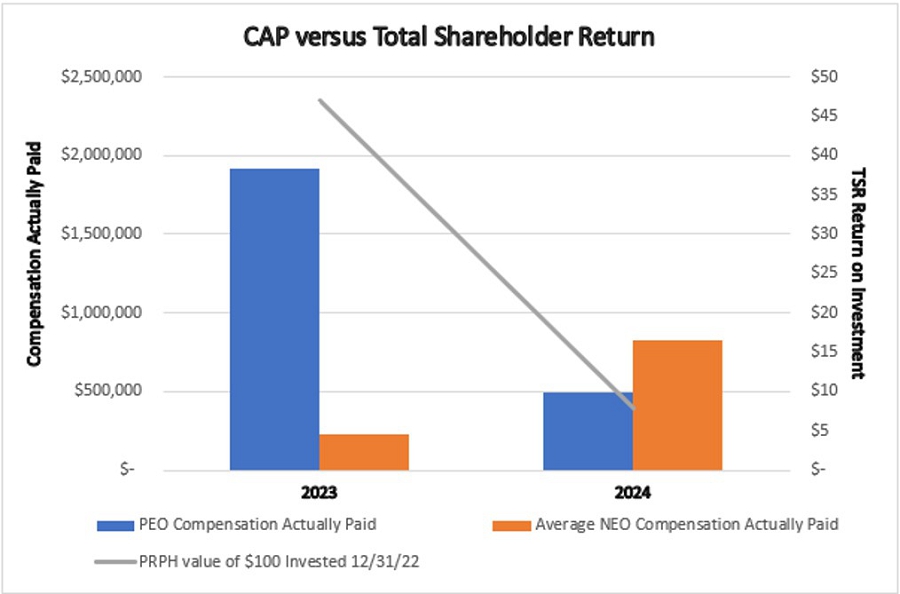

Compensation Actually Paid and Company TSR

The graph below shows the relationship between (1) compensation actually paid to our PEO and the average of the compensation actually paid to our other NEOs and (2) our cumulative TSR, over the two fiscal years ending December 31, 2024.

| 18 |

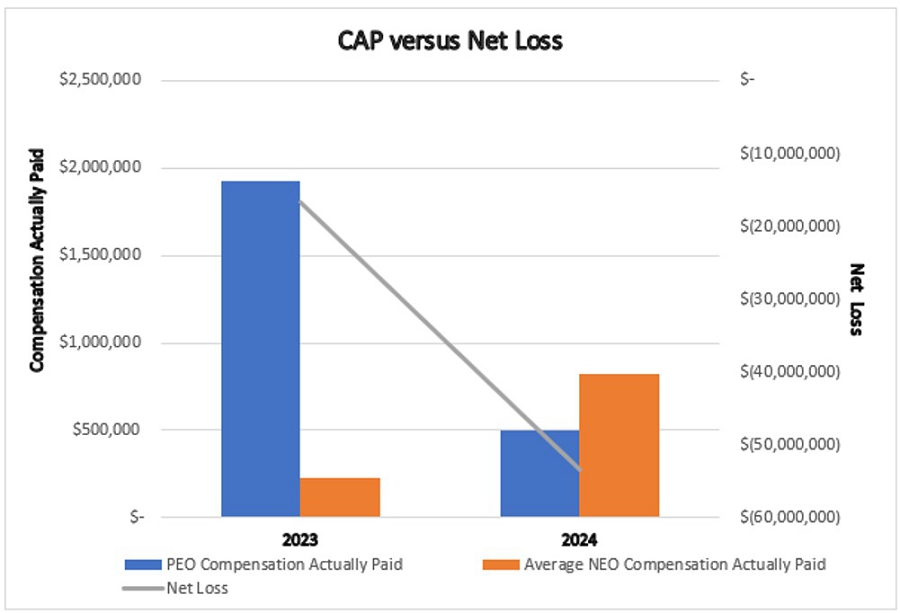

Compensation Actually Paid and Net Loss

The graph below shows the relationship between compensation actually paid to our PEO and the average of the compensation actually paid to the Other NEOs and net loss attributable to the Company over the two fiscal years ending December 31, 2024, as reported in the Company consolidated financial statements.

Director Compensation for 2024

In setting director compensation, the Board considers the significant amount of time that directors expend in fulfilling their duties to the Company. Only non-employee directors are entitled to compensation for Board service.

For the period beginning July 1, 2023 and ending June 30, 2024 (the “2023 Director Period”), our non-employee directors are entitled to receive:

| ● | a $35,000 annual cash service retainer (to be paid in quarterly installments beginning September 30, 2023); and | |

| ● | a stock option to purchase 40,000 shares of the Company’s common stock with an exercise price of $7.31 per share (the closing price of the Company’s common stock on the grant date); vesting in four equal quarterly installments of 10,000 shares over one year, with the first quarterly installment vesting on September 30, 2023 and each additional installment vesting quarterly thereafter, subject to the director’s continued service with the Company on each such vesting date. |

For the period beginning July 1, 2024 and ending June 30, 2025 (the “2024 Director Period”), our non-employee directors are entitled to receive:

| ● | a $15,000 annual cash service retainer (to be paid in quarterly installments beginning September 30, 2024); and | |

| ● | a stock option to purchase 70,000 shares of the Company’s common stock with an exercise price of $6.00 per share (the closing price of the Company’s common stock on the grant date); vesting in four equal quarterly installments of 17,500 shares over one year, with the first quarterly installment vesting on September 30, 2024 and each additional installment vesting quarterly thereafter, subject to the director’s continued service with the Company on each such vesting date. |

| 19 |

Stock options granted under the director compensation program are granted under the Company’s Amended and Restated 2022 Directors’ Equity Compensation Plan (the “2022 Directors’ Plan”) with an exercise price equal to the Fair Market Value (as such term is defined in the 2022 Directors’ Plan) of our common stock on the date of grant.

We reimburse each non-employee member of our Board for out-of-pocket expenses incurred in connection with attending Board and committee meetings. Non-employee directors do not participate in any nonqualified deferred compensation plan and we do not pay any life insurance policies for the directors.

| Name (1) | Fees Earned or Paid in Cash ($) | Option Awards (2) | Total ($) | |||||||||

| Jason Barr | 17,5000 | 163,000 | 180,500 | |||||||||

| Louis Gleckel, MD | 26,250 | 163,000 | 189,250 | |||||||||

| Warren Hirsch | 26,250 | 163,000 | 189,250 | |||||||||

| (1) | Our employee directors do not receive director fees. Accordingly, Mr. Ted Karkus is not entitled to, and did not receive, any compensation for his service on the Board in 2024. |

| (2) | For each of the non-employee directors, this amount relates to a stock option to purchase 70,000 shares of the Company’s common stock granted to each of the non-employee directors on March 17, 2024 for the 2022 Director Period. The amounts reported represent the aggregate grant date fair value of the option awards granted to the non-employee directors in March 2024, determined in accordance with FASB ASC Topic 718. For a discussion of the assumptions and methodologies used to value the option award granted, see Note 7 “Stockholders’ Equity” to the financial statements included in our 2024 Annual Report. |

As of December 31, 2024, Dr. Gleckel held options to purchase an aggregate of 350,000 shares of common stock and Mr. Hirsch held options to purchase an aggregate of 250,000 shares of common stock.

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information regarding ownership of our common stock as of April 29, 2025 by (a) each person known to the Company to own more than 5% of the outstanding shares of our common stock, (b) each director of the Company, (c) the named executive officers for the last completed fiscal year of December 31, 2024 and (d) all current directors and executive officers as a group as of April 29, 2025. Unless otherwise indicated, the address of each person or entity listed below is the Company’s principal executive office.

| Name of Beneficial Owners | Common Stock Beneficially Owned(1) | Percent of Class (%)(2) | ||||||

| Officers and Directors | ||||||||

| Ted Karkus(3) | 3,215,329 | 7.6 | % | |||||

Jed Latkin | — | — | ||||||

| Louis Gleckel, MD(4) | 436,340 | 1.0 | % | |||||

| Warren Hirsch(5) | 232,500 | * | ||||||

| All Current Directors and Executive Officers (4 persons)(6) | 4,109,169 | 9.6 | % | |||||

* Less than 1%

| 20 |

| (1) | Beneficial ownership has been determined in accordance with Rule 13d-3 (“Rule 13d-3”) under the Exchange Act, and unless otherwise indicated, represents shares for which the beneficial owner has sole voting and investment power. |

| (2) | The percentage of class is calculated in accordance with Rule 13d-3 based on 41,879,017 shares outstanding on April 29, 2025. Shares of common stock that a person has the right to acquire within 60 calendar days of April 29, 2025 are deemed outstanding for purposes of computing the percentage ownership of the person holding such rights, but are not deemed outstanding for purposes of computing the percentage ownership of any other person, except with respect to the percentage ownership of all executive officers and directors as a group. |

| (3) | Includes 138,600 shares held by Mr. Karkus’ son who resides with him and for which Mr. Karkus may be deemed the beneficial owner. |

| (4) | Includes options to purchase 332,5000 shares that are vested or will vest within 60 days of April 29, 2025. |

| (5) | Includes options to purchase 232,500 shares that are vested or will vest within 60 days of April 29, 2025. |

| (6) | Includes options to purchase 990,000 shares that are vested or will vest within 60 days of April 29, 2025. |

Equity Compensation Plan Information

The table below sets forth information with respect to shares of common stock that may be issued under our equity compensation plans issued as of December 31, 2024:

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders(1)(2)(3) | 3,330,000 | $ | 6.74 | 705,785 | ||||||||

| Equity compensation plans not approved by security holders(4) | 550,000 | $ | 6.02 | - | ||||||||

| Total | ||||||||||||

| (1) | At December 31, 2024, there were 2,286,124 shares of our common stock issuable pursuant to stock options outstanding under the 2022 Plan. At December 31, 2024, there were 1,093,285 shares of common stock that were available for issuance pursuant to the 2022 Plan. |

| 21 |

| (2) | At December 31, 2024, there were 665,126 shares of our common stock issuable pursuant to stock options outstanding under the 2022 Directors’ Plan. At December 31, 2024, there were 210,000 shares of common stock that were available for issuance pursuant to the 2022 Directors Plan. |

| (3) | At December 31, 2024, no stock options were outstanding under the 2018 Stock Incentive Plan. At December 31, 2024, there were no shares of common stock that were available for issuance pursuant to the 2018 Stock Incentive Plan. |

| (4) | Represents the number of shares of our common stock underlying stock option awards granted as inducements material to employees entering into employment with the Company in accordance with Nasdaq Listing Rule 5635(c)(4) and outstanding as of December 31, 2024. |

| Item 13. | Certain Relationships and Related Transactions and Director Independence |

Certain Relationships and Related Transactions

In accordance with the terms of the charter of our Audit Committee, the Audit Committee must review and approve the terms and conditions of all related party transactions. “Related party transactions,” as described in Item 404(a) of Regulation S-K promulgated by the SEC generally refer to any transaction, arrangement or other relationship, or any series of similar transactions, arrangements or relationships in which we were or are to be a participant, where the amount involved exceeds the lesser of (i) $120,000 and (ii) one percent (1%) of the average of our total assets at year-end for the prior two fiscal years (which was approximately $89.8 million), and in which any director, executive officer or holder of more than five percent (5%) of our voting securities (or affiliates or immediate family members of such persons) had or will have a material interest.

Since January 1, 2024, there have been no related party transactions except as described below.

Jason Karkus, President of Nebula Genomics, a wholly-owned subsidiary of the Company, since January 2024, and prior to that Executive Vice President and Co-Chief Operations Officer of ProPhase Diagnostics, Inc., a wholly-owned subsidiary of the Company, is the son of Ted Karkus, our Chairman and Chief Executive Officer. For 2024, Mr. Jason Karkus received an annual base salary of $320,000, a bonus of $100,000 for his significant contributions related to the growth of ProPhase Diagnostics, Inc. and Nebula Genomics, Inc., a $7,800 vehicle allowance, and a $16,800 matching contribution in the Company’s 401(k) defined contribution plan. He also received stock options with a value of $1,2200,000 in 2024 that vest in four equal installments starting on the grant date. The compensation paid to Mr. Karkus was approved by the Company’s compensation committee and audit committee.

Director Independence

As required by Nasdaq listing standards, a majority of the members of our Board must qualify as “independent,” as affirmatively determined by our Board. Our Board consults with our legal counsel to ensure that its determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in the applicable Nasdaq listing standards.

Based on these standards, upon the recommendation of our Nominating and Corporate Governance Committee, the Board has affirmatively determined that each of our current non-employee directors is “independent,” as defined by the applicable listing standards of Nasdaq. Thus, three of our four current directors are independent under the listing standards of Nasdaq. Mr. Karkus is not considered independent because he is an employee of the Company.

| 22 |

| Item 14. | Principal Accountant Fees and Services |

The table set forth below lists the fees billed to the Company by Fruci & Associates II, PLLC, the Company’s current principal accountant for 2024 and Morison Cogen LLP, the Company’s former principal accountant, for 2023 and the first three quarters of 2024, as described below.

| Description | 2024 | 2023 | ||||||

| Audit fees(1) | $ | 454,000 | $ | 271,000 | ||||

| Audit-related fees(2) | 26,500 | 75,400 | ||||||

| Tax fees | — | — | ||||||

| All other fees | — | — | ||||||

| Total | $ | 480,500 | $ | 346,000 | ||||

| (1) | Audit fees consist of fees related to the audit of our annual financial statements and reviews of our quarterly financial statements. |

| (2) | Audit-related fees consist of fees related to comfort letter procedures and the provision of an audit opinion given in connection with our transition of auditors. For 2024 $7,500 in fees billed were billed by Morison Cogen LLP. For 2023, the $75,400 in fees billed were billed by Marcum who merged with Friedman LLP in September of 2022. |

The Audit Committee reviews and pre-approves all audit and non-audit services to be provided by the independent auditor (other than with respect to the de minimis exceptions permitted under applicable law). This duty may be delegated to one or more designated members of the Audit Committee with any such pre-approval reported to the Audit Committee at its next regularly scheduled meeting.

| 23 |

PART IV

| Item 15. | Exhibits and Financial Statement Schedules |

(a)(1) Financial Statements.

See Index to Financial Statements, which appear on the Original 10-K. The consolidated financial statements listed in the accompanying Index to Financial Statements are filed therewith in response to this Item.

(a)(2) Financial Statement Schedules.

All schedules have been omitted because they are not required or because the required information is given in the consolidated financial statements or Notes thereto set forth under Item 8 above.

(a)(3) Exhibits

| 24 |

| 25 |

| 97.1 | Compensation Recovery Policy (incorporated by reference to Exhibit 97.1 of the Annual Report on Form 10-K (File No. 000-21617) filed on March 29, 2024). | |

| 101 INS** | Inline XBRL Instance Document | |

| 101 SCH** | Inline XBRL Taxonomy Extension Schema Document | |

| 101 CAL** | Inline XBRL Taxonomy Extension Calculation Linkbase Document | |

| 101 DEF** | Inline XBRL Taxonomy Extension Definition Linkbase Document | |

| 101 LAB** | Inline XBRL Taxonomy Extension Label Linkbase Document | |

| 101 PRE** | Inline XBRL Taxonomy Extension Presentation Linkbase Document | |

| 104** | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Indicates a management contract or compensatory plan or arrangement.

** Filed herewith.

† Confidential treatment granted as to portions of the exhibit. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit to the Securities and Exchange Commission upon request.

+ Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit to the Securities and Exchange Commission upon request.

| Item 16 | Form 10-K Summary |

None.

| 26 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: April 30, 2025

| PROPHASE LABS, INC. | ||

| By: | /s/ Ted Karkus | |

Ted Karkus, Chairman of the Board, Chief Executive Officer and Director | ||

| 27 |

POWER OF ATTORNEY